Get your houses in order!

That’s the message resonating loud and clear to the finance industry from the ASIC RG-271 dispute resolution standards.

If your organisation wants to meet the new compliance standards by October 5, now is the time to act on updating your systems for managing complaints. And although October 5 seems a while away, the D-day drums are already beating.

Why all the fuss about RG-271?

ASIC introduced the RG-271 to improve the way financial services organisations manage and resolve business disputes. Recognising the value of customer feedback as a source of early systemic warnings, the commission reduced the timeframes for responding to complaints. It outlined what information should be in a written Internal Dispute Resolution (IDR) response, to make it easier for consumers to decide whether they want to escalate their complaints.

Capturing and tracking conversations in time will help resolve IDR issues before they escalate. The regulatory guide wants organisations to make more progress by “increasing the capture, tracking, analysis and reporting of complaint data.”

Voice data is a critical element of any business’s overall data set. Voice data is generated from recordings of conversations and the meta-data associated with those conversations.

To effectively meet the new mandate, financial services organisations will need to start call recording and implement workflows to capture compliance mishaps. What this means is they will need to quickly identify when a customer is expressing signs of distress, anger or frustration and build up efficient ways to respond in time.

Rather than this being a matter of opinion or interpretation, AI can tell you in real-time what is the sentiment being expressed by customers in every conversation. This can happen across any interaction point including call centres, mobile consulting calls, video conferencing meetings.

The red button issue – Financial organisations that don’t get their house in order in time could face penalties mounting to thousands of dollars.

Innovation leap in compliance technology brings good news

On the flip side, better IDR not only benefits consumers and small businesses, it equips the financial services boards with rich real time data on the customer experience and gives them a new lens into whether their customer’s needs are being met or not. Although the task can be daunting, regtech solutions such as Dubber accelerate dispute resolution and documentation and provide the foundation for proactive risk management and continuous compliance.

Breakthroughs in voice intelligence step up IDR management

Cloud-based Voice Intelligence is just one example of how technology is leading the way to answering the demands of a tightly regulated compliance environment. Voice intelligence done right makes it possible to create a continuous compliance loop that records, monitors conversations 24/7 and send alerts when organisations need to act on problematic conversations, before they escalate into a dispute.

Anticipating a growing need for smarter voice-driven compliance management, Dubber stepped up to offer a simple and affordable way to quickly meet the new mandates with confidence. One of the advantages of Dubber Voice AI; it can pick up when customers are dissatisfied through sentiment analysis and send an auto-alert to the compliance teams.

To help you ramp up your compliance in time for RG-271, Dubber can take you through the steps – no matter what the size of your organisation.

While the human brain can do wonderful things, it isn’t always the best tool for retaining information.

Don’t worry if this sounds familiar. Even bright, healthy adults are forgetful. We’re designed that way. And it’s a good thing.

Cognitive science professor Art Kohn says people are quick to forget. He talks about something he calls The Forgetting Curve. Kohn says one hour after learning new information the majority of people will have forgotten half of it.

A day later, the average person will be unable to recall 70 percent of the material. By the end of the week that figure will hit 90 percent. There will be people who do better and others who do worse. “In general the situation is appalling. Nearly everything you teach employees in company training sessions will be forgotten,” says Kohn.

This should not come as a surprise. A human brain is efficient precisely because it spends much of its time editing out unnecessary incoming information in order to focus. Along the way it will edit out important material along with the barrage of trivia coming our way every moment of the day.

Kohn talks specifically about corporate training. He worries that forward-looking businesses who spend vast sums preparing staff for new challenges may not get the value they hope for. The Forgetting Curve is a problem in other areas of business. People forget things all the time. They forget conversations, instructions, sales calls any one of dozens of interactions that take place during a working day.

With Dubber’s Unified Call Recording, there is no need to forget any interaction that takes place on a phone or video call. Unified Call Recording can capture every conversation and store it for later recall. The voice data is converted to text, date stamped and made searchable.

This means you can retrieve an accurate record of any conversation, presentation or training session. Even if our efficient, but flawed, human brain can do no better than recall it happened last Thursday morning or that it involved sending widgets to Brisbane.

Highlights from a recent Regtech and Dubber Webinar

How can managers navigate through growing compliance complexities when work happens everywhere? How do you regain control in a business communication world that is siloed into multiple voice chats, video channels, networks and devices? Will AI technology save the day, or are technology firms spreading more pixie dust?

COVID complicates compliance but isn’t the only driver of complexity

COVID complicated an already complex compliance world, adding a plethora of systems, communications tools and places over which compliance now needs to be managed. The volume, velocity and virality of customer conversations across Zoom videos, MS meetings, WhatsApp recordings, mobile conversations…, calls for new ways to track and monitor mounting mishaps and breaches.

Although some regulations were paused at the outset, they are back in force.

Underlying the complications of COVID are a range of broader changes challenging compliance teams: New communications preferences (think WeChat, Whatsapp and Signal) amongst customers and employees; the rise of video as a dominant communications medium; and the inevitability of Bring Your Own Device (BYOD) in the workplace.

Discussion on these drivers, and the challenges they pose to compliance leaders were at the centre of our recent Webinar with Regtech.

A return to mandatory conversation recording

While call and conversation recordings are mandatory for crucial conversations in most countries, they’re limited by legacy solutions, and the ability to compliantly capture them on leading communications platforms where video, calling and messaging converge.

In many environments, 80% of crucial customer conversations are voice, yet less than 10% of these conversations are captured. This percentage slides down as more conversations shift off legacy communications systems. For financial institutions, 50% of customer conversations now occur outside of the call centre. The status-quo is not about to change soon; 61% of financial service CFOs plan to make remote work permanent post-pandemic.

The financial pain is real

Last year alone, $10.4B of compliance fines and penalties were handed to financial institutions. Many of them were related to data privacy breaches. So how do you capture, retain and analyse crucial datasets when user end-points are dispersed across mobile, web and many other channels?

Not surprisingly, in the UK, the FCA mandate to record every voice conversation returned after recognising growing compliance gaps in a dispersed workforce that continues to operate across multiple communication channels.

But in a new reality where employees are hopping across MS Team meetings, Zoom videos, WhatsApp recordings and mobile voice calls, the compliance chasm is still there and growing.

The drive to continuous compliance

“The industry has come a long way from the days when the only option to access data was through spreadsheets. Now huge amounts of data are available on the cloud, and can be accessed almost instantly. This is a massive improvement.” – Regtech Webinar

The C-suite is still largely unaware of its ability to mine voice data outside the call center. There’s a clear opportunity for chief compliance officers to preserve core compliance data in a compliance cloud and be a primary data source for businesses. And critically, to aggregate voice conversations from across the business in one record system.

At the end of the day, the ability to monitor customer conversations, end not knowing, and run them at scale shifts you into a new mode of continuous compliance.

AI, compliance risks and red flags

There’s a lot of talk about driving Artificial Intelligence (AI) compliance models, and some industry kickback. But the future of AI-driven compliance is bright, and from a functionality stance, the timing couldn’t be better.

“The industry is responding positively to the different aspects of AI and what it can deliver from a compliance perspective. The future of compliance lies in the ability to harness artificial intelligence for many compliance tasks.”

The question is, how do we get to the point where we can predict mishaps and conversations that can go rogue, rather than constantly looking in the rear view mirror? This is one of the areas where innovation, AI and analytics are most likely to deliver significant compliance benefits.

If you can predict problems more effectively, you can fix them faster and more easily. You can deliver more tangible benefits and reduce the likelihood of remediation projects.

Unified vs. siloed voice communications

Global compliance leaders can no longer afford to maintain the status quo. They need to continuously monitor voice and chat platforms no matter where their teams and customers are globally positioned. Country-specific data sovereignty requirements also need to be met. So to PCI, and myriads of other regulations.

A shift to continuous compliance intelligence

“At the end of the day, call recording is just an activity. What matters is creating a compliance record system driven by voice data. It’s about integrating that data with other data sources and applications. And then from that compliant data set, fuelling AI-enriched alerts, notifications, workflows, dashboards, and more.”

“Compliance leaders need to look beyond a single application to do this and target a data-first strategy that powers any application they desire.” Andy Lark, Chief Customer Officer, Dubber.

Leaders in the future will need to track and instantly retrieve datasets from cloud-based platforms, with storage capacities up to five, or even seven years. With the tsunami of data from myriads of voice and video conversations, it could pay to spend time on data-driven strategies to flag alerts, gain insights into potential risk, and expedite proactive compliance.

One of the key principles that guide us as a SaaS company is Dubber should get automagically better every day. So, over the past quarter, we’ve been busy behind the scenes making Dubber native to the world’s most popular calling and video solutions and adding cool new features.

Here are a few of the new places Dubber can be turned on with a click.

We recently announced the expansion of our AT&T relationship by offering compliant Unified Call Recording across 3 major AT&T networks: AT&T IP Tool Free, AT&T Hosted Voice Service and Cisco Webex calling with AT&T Business. This is only the start, as Dubber’s multi-network integration across AT&T and their partner platforms means users can now switch on Dubber with a click across AT&T’s Business portfolio, substantially broadening access to the customer voice insights across the entire enterprise.

Like you, we’ve found ourselves working from everywhere and relying on the best UC solutions to stay connected. Now, whatever you’re on, you’ll be able to record, get alerts and insights and do more. And you’ll be able to do it knowing you are complying with global data privacy and financial regulations – unlimited by storage constraints – with AI-enriched insights – and easy access through the Dubber App and Web console.

One of the great things about Unified Call Recording is all your recordings, data, transcripts and insights are in one place. So, if you are recording your own or your team’s calls and videos across mobile, Microsoft Teams, Cisco WebEx, and Zoom – they will all be conveniently in your inbox. And unlike other solutions requiring hardware, professional services, unique SIM cards, and call forwarding, we’ve integrated Dubber with these platforms, so Unified Call Recording can simply be available at a switch.

Here are a few of the integration highlights

- Dubber on Zoom: The recent Dubber – Zoom integration made it possible for Zoom users to access enhanced recording and voice analytics of millions of Zoom meetings and Zoom phone conversations

- Microsoft Teams Compliance Certification: Dubber just became one of the first unified call recording solutions to receive the Microsoft Teams compliance recording certification. Finally, businesses in regulated industries such as banking, government, insurance and financial services can easily meet legal and regulatory obligations for their Microsoft Teams users in call centres, offices, and work-from-anywhere environments

- Salesforce – Dubber integration: The recent addition of Dubber to the Salesforce AppExchange solves multiple issues. Salesforce users can now compliantly capture customer interactions, reduce administration, proactively manage accounts, and continuously improve deals by accessing insights and sentiment analysis. The newfound visibility also means salespeople can quickly search for information in their conversations, opportunities can be filtered by keywords, and managers can help teams win more deals

Cool new features

Dubber just got better with a slew of features to level up the customer experience and end not knowing. These new features don’t just add clarity, they ensure compliance is better managed and disputes are more easily solved.

- Enhanced AI Speaker Detection: Dubber now has an enhanced capability to detect speakers in a recording. As a result, Dubber transcriptions are more beautiful and more conversational, improving overall readability and insights

- AI Question Detection: Another boost to transcription readability was made by adding question marks

- Legal Hold: Now compliance-focused teams can protect recordings from deletion by user, by retention period, or accidental, ensuring that every recording can be retrieved at any time

- Transcription crosstalk elimination: Transcription quality often reduces when it comes to deciphering crosstalk. Recognising the gap Dubber built-in dual-channel transcriptions. The new capability eliminates transcription errors caused by cross talk and improves transcriptions when a caller is in a noisy environment

- IdP SSO: Security is a crucial pillar of the Dubber Platform, which is why we’ve enabled enterprises the overarching ability to control security and identity information. New Dubber customers can configure idP SSO during the account creation process while existing customers can add this functionality by requesting it through their account manager or support contact

We’re not stopping here. Dubber will continue to power on to deliver Unified Call Recording and voice intelligence solutions and end not knowing.

Let’s chat if you’d like a demo of our new integrations and features!

Dubber Corporation Limited (ASX: DUB) (‘Dubber’ or ‘the Company’), the leading global Unified Call Recording & Voice Intelligence cloud service designed for service providers and businesses of any size, is pleased to release an update on the Company’s operating focus along with the Appendix 4C for the quarter ended 31 March 2021.

Highlights:

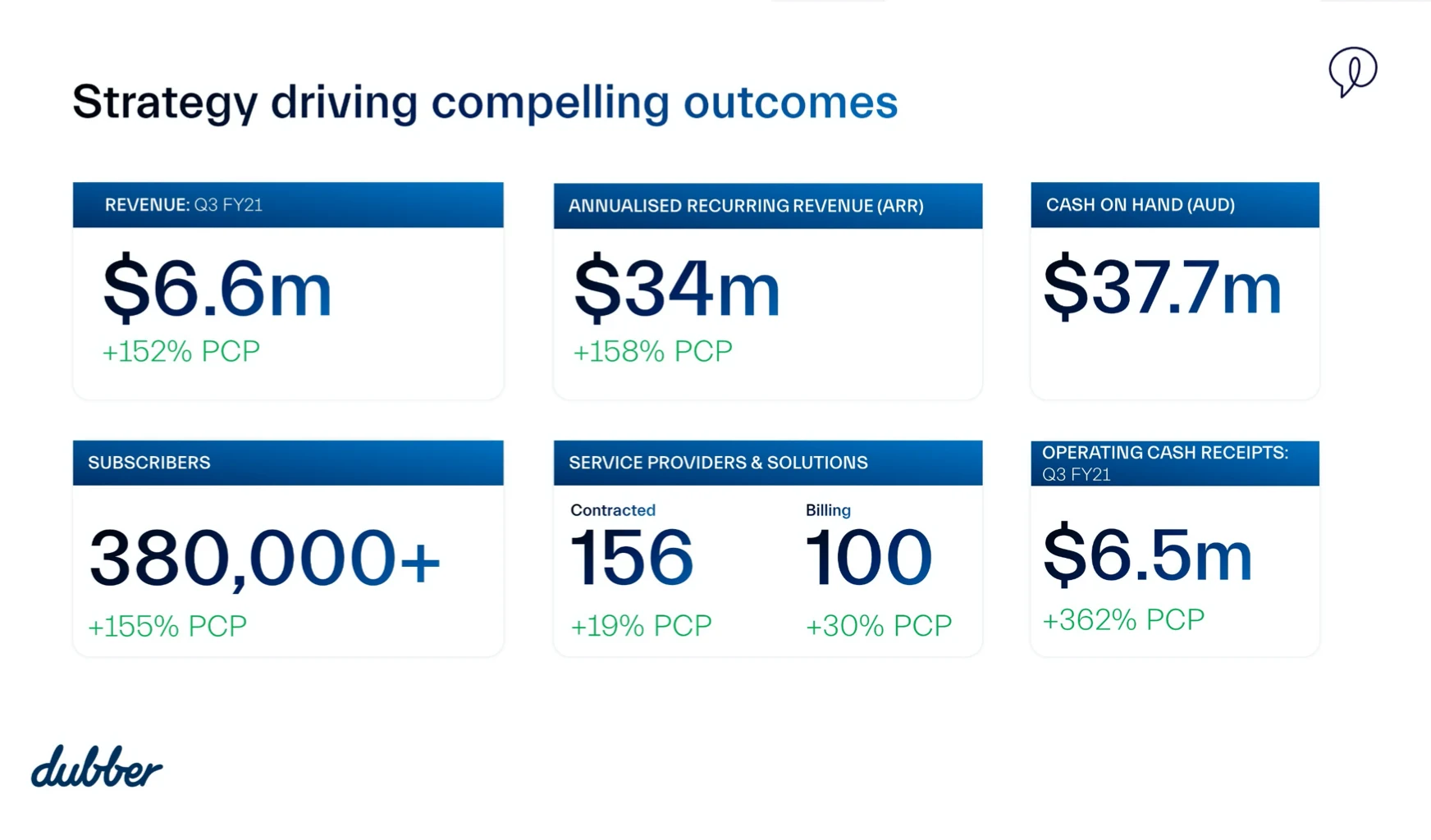

- Annualised Recurring Revenue (ARR) increased 20% QoQ ($5.6m) to $34m and 158% pcp ($13.2m)

- Revenue increased 54% ($2.32m) to $6.6m QoQ and 152% pcp ($2.61m)

- Operating cash receipts increased 54% ($2.31m) to $6.55m QoQ and 362% pcp

- Dubber users now exceed 380,000

- The Company has a strong balance sheet, with in excess of $37.7m as at 31 March 2021

Growth in all key metrics – Users and ARR

During the March quarter the Company’s key metrics all experienced substantial growth.

User numbers grew at a record rate for Dubber’s SaaS monthly subscriptions. The Company expects user growth to increase significantly in the current quarter due to new initiatives including the launch of its Foundation Partner Program. Foundation Partners embed Dubber services within their offering as a standard and in-built feature – from which both Dubber and the partner then benefit from upgrading users to richer functionality and offerings.

The March quarter represents a milestone period relating to comparative user growth quarter on quarter.

The Company expects to receive Foundation and consumption-based revenues moving forward with larger and varying user attachment rates to those revenues. Therefore, as previously indicated, the key growth metric relating to short term growth is the Company’s Annualised Recurring Revenue (ARR) which has grown by $5.6m, to in excess of $34m.

Telecommunications Networks Growth and Yield

The Company continued to expand its footprint of service provider networks along with increasing penetration and revenue yield from its current telecommunication and Unified Communication (UC) platform partners.

AT&T

During the quarter, the Dubber platform went live on three AT&T networks: AT&T IP Toll-Free, AT&T Hosted Voice Service (HVS), and Cisco Webex Calling with AT&T. All three of these networks target large enterprise, government, education, and business clients. The HVS and Webex Calling networks are already providing positive uptake in SaaS monthly subscription users and services.

AT&T’s IP Toll-Free is a major global network carrying calls for the largest organisations in North America and is billed on a per minute consumption rate. Dubber’s recording, API, transcription and AI services will also be billed on a per minute rate at accretive unit increments, thereby introducing meaningful consumption based revenue streams to Dubber.

Currently, AT&T and IBM are engaged with existing mutual large enterprise customers to demonstrate the value of the newly available services on the platform which add substantial insights to those organisations, enabling them to gain valuable business intelligence from their voice data.

The Company expects the Dubber platform to be live on additional AT&T networks in both the short and medium term.

Unified Call Recording Momentum

The Company has previously referenced Unified Call Recording (UCR) which defines the Company’s unique value proposition of unifying call recording and voice data at scale. UCR reflects how businesses and individuals work today, particularly in Covid-19 driven ‘work from home’ settings and hybrid work environments.

The Company has recently become one of only two vendors certified for Compliant Call Recording for Microsoft Teams.

Dubber is already the embedded and only recording offering for Cisco’s Webex Calling platform with the Company expecting to substantially extend its relationship and availability with Cisco Webex in the near term.

During the quarter, the Company also announced availability of a Unified Call Recording solution for Zoom that allows for secure compliance and voice intelligence call recording for Zoom Meetings as well as Zoom’s recently launched cloud phone service, Zoom Phone.

Typical business communications usually involve the use of desk phones, mobiles, and UC services such as Cisco Webex, Zoom and Microsoft Teams. Dubber is uniquely placed to be able to capture recordings and voice data from all services and store them in a single location, the Dubber Voice Intelligence Cloud, where they can be managed centrally.

Behind these UC platform announcements is an industry trend whereby large global service providers are releasing their own network offerings in conjunction with cloud collaboration platforms like Zoom Phone, Microsoft Teams and Cisco Webex Calling. Dubber has detected a pronounced acceleration of telecommunication services moving to a cloud environment, either from traditional telecommunications carriers or by stand-alone UCaaS services in the last two quarters. By virtue of its unique ability to be embed into the fabric of a network and operate at scale, the company is a significant beneficiary of this trend and we believe it will continue to accelerate globally in the quarters ahead.

Foundation Partner Program

The Dubber platform has been designed specifically for large scale availability across telecommunications networks, as opposed to legacy bespoke recording products for enterprises, which are largely tied to on premise equipment, capital expenditure and call centre environments.

The Company expects several of its service provider partners to deploy the Dubber platform as a standard feature across their network base as “Dubber Foundation Partners”. The Company is actively engaged in discussions with major service providers to become Foundation Partners and expects the first initiative of this kind will take place in the current quarter.

This will provide the Company large scale customer reach into end user accounts for jointly upselling additional services, including extended storage, transcription, AI insights and more.

Steve McGovern, CEO, Dubber:

“We are delighted to have delivered such a strong quarter, achieving outstanding growth in all of our key metrics. The company is very well positioned to continue to take advantage of the major shift towards cloud based and ‘work from anywhere’ communications we are seeing in all our geographies. Governments and businesses understand the need to act on the requirement to capture conversations and voice data across their entire business. Ever expanding requirements to record and store conversations for proactive compliance and dispute resolution, and, revenue, customer and personnel intelligence all continue to drive the need for voice data and intelligence at scale. We remain very positive as to Dubber’s growth and leadership.”

Related Party Expenses

In line with requirements of lodgement of the attached Appendix 4C, the Company advises that payments shown in Item 6.1 of the Appendix 4C are in relation to Executive and Non-Executive Director remuneration (including superannuation) and form part of the operating expenses for the March quarter.

This ASX release has been approved for release to ASX by Steve McGovern, CEO & Managing Director.

Download the ASX release and Appendix 4C here (PDF)

About Dubber:

Dubber is unlocking the potential of voice data from any call or conversation. Dubber is the world’s most scalable Unified Call Recording service and Voice Intelligence Cloud adopted as core network infrastructure by multiple global leading telecommunications carriers in North America, Europe, and Asia Pacific. Dubber allows service providers to offer call recording for compliance, business intelligence, sentiment analysis, AI and more on any phone. Dubber is a disruptive innovator in the multi-billion-dollar call recording industry, its Software as a Service offering removes the need for on-premise hardware, applications or costly and limited storage.

For more information, please contact:

Investors

Simon Hinsley simon.hinsley@dubber.net

+61 (0) 401 809 653

Media

Terry Alberstein terry@navigatecommunication.com.au

+61 (0) 458 484 921

How is Voice AI meeting a growing need for faster, more accurate compliance management?

And why does Voice AI work hand-in-hand with proactive compliance?

At a recent IBM – Dubber webinar and round table, compliance industry leaders across the country talked about major compliance mandates affecting their performance. They were troubled by the new Work-from-Anywhere reality and how it’s off-setting rising regulatory demands on financial services and other industries.

During the webinar, fintech expert and Chief Customer Officer of Dubber, Andy Lark, together with Anthone Withers, Head of Public Cloud at IBM discussed the rising role of voice intelligence in stepping up compliance and removing legacy obstacles. They focused on how voice intelligence technology is meeting a growing demand for proactive compliance reporting.

See key takeaways on how to meet rising regulatory demands in 2021

Research shows a growing need to manage voice data in compliance

A history of compliance failures, cross-border mandates, and the growing list of guidelines since the Hayne Royal Commission and GFC are turning compliance and risk management into an increasingly complex task.

The Hayne Royal Commission claimed compliance was highly challenged by the common malpractice of using voice conversations to sell inappropriate products to customers. Deloitte in response, advised the industry to invest in compliance programs that embed data into their DNA. With the shift to data-driven compliance, voice data was inadequately addressed or was missing altogether.

A once impossible task now possible

“Voice has largely been captured in silos and locked into those silos. A voice intelligence platform now enables any conversation to be captured from any eligible end-point, then stored and analysed in a single compliant cloud instance.” Andy Lark, Dubber.

When coupled with IBM Watson, voice data is transformed into intelligent compliance insights. The combination shifts financial services and other regulated industries from a rear-view perspective to always knowing in real time.

When Covid hit and created a new ‘work-from-anywhere’ reality, compliance teams needed to capture and track conversations over a huge set of new endpoints and apps including mobile, Zoom, MS Teams, Cisco Webex and more. Suddenly, the impossible task of managing voice data at scale called for voice intelligence tools powered by Artificial Intelligence (AI).

The power of combining voice data with Watson IBM

Unleashing IBM Watson with Dubber Voice AI on conversation datasets ushered in a new way to analyse conversational data while managing it in a secure environment.

The IBM Watson – Dubber partnership made it finally possible for managers to gain insights into customer conversations and leverage predictive analytics. Managers could now use triggers on keywords and alerts to search and generate reports in real time.

A brave new remote world jeopardizes compliance mandates

“We’ve seen a surge in the use of Cisco Webex, Microsoft Teams, Zoom and more. The meeting online tsunami has created the need for compliant call recording, with all recordings – mobile, web and traditional handsets, unified in one place.” Andy Lark, Dubber

This switch to off-premise communications gave rise to a new remote worker and a growing reliance on mobile devices and applications. With that, new compliance issues arose. For instance, when remote financial workers recorded a business meeting on a popular application, unknowingly they broke many industry compliance mandates.

In effect, the data was not stored in a sovereign way, a privacy notification was not issued and workers were not redacting key data. Personal call recording simply did not meet compliance standards.

Time to knowing

“The new challenge is the time it takes to know if your compliance standing has been compromised.” Andy Lark, Dubber.

Traditional approaches to call recording resulted in useful dashboards for managing a call centre but today do little to meet the needs of compliance teams required to search terabytes of data in real time across multiple end-points – Or more importantly, being alerted on information misuse and policy breaches.

“Together with IBM we solved this at scale by enabling vast conversational data sets to be created and turning them into compelling insights” – Andy Lark, Dubber

Let’s look at a typical bank breach use case: Let’s say there is a serious customer complaint flagged across five years. The average time to assemble data could take up to eight hours of needle-in-a-haystack work. But with Watson IBM and Dubber, the task is reduced to 10 seconds. Anthone Withers pivoted to other important advantages: “You have proof, you have a transcript highlighting keywords that shouldn’t be in the conversation and you have sentiment analytics. Better still, all these insights that expose risk can be pulled into dashboards and reports in real time.”

In summary

Digital acceleration and remote work added multiple communication end-points that began to severely compromise compliance and fraud detection, just as regulatory demands were growing. What’s become clear is; compliance solutions that integrate voice intelligence can produce more cost-efficient and more productive compliance practices, and finally, deliver proactive compliance.

- Dubber delivers recording for Zoom and Zoom Phone

- Helps to enable fulfilment of increasing regulatory requirements in relation to ‘work from home’ and distributed workforces

- Dubber with Zoom allows secure UCR and Voice AI for businesses of all sizes

Melbourne, Australia, and Dallas, Texas – 14 April 2021 — Dubber Corporation Limited (ASX: DUB) (Dubber), today announced that it has extended its Unified Call Recording footprint with the global availability of Dubber with Zoom Video Communications, Inc.’s (NASDAQ: ZM) video-first unified communications platform.

Dubber Unified Call Recording with Zoom provides businesses of all sizes the ability to record calls for all users. Once the recordings are ingested by Dubber, businesses can enrich the content with AI delivering transcriptions, sentiment data, real-time search and more. Dubber’s solution spans service provider networks, Zoom and other communications solutions, enabling Enterprise and Government to centralise all conversation recordings, data and insights in the Dubber Voice Intelligence Cloud.

“Unified Call Recording with Zoom reflects the way employees work today – from anywhere and across many devices and solutions. Dubber has been chosen by over 150 telecommunications carriers and service providers as the recording and data capture platform for their networks. Many have embraced Zoom as an integral part of their business and communications infrastructure. The ability to capture recordings from Zoom and manage them centrally in the Voice Intelligence Cloud demonstrates the true value of Unified Call Recording,” said Steve McGovern, CEO, Dubber.

“Many of our carrier partners are also developing strategies for Zoom Phone, enabling unified management of recordings and voice data across multiple networks and solutions. For Dubber this opens the door to an opportunity to provide enhanced recording and voice analytics to the millions of Zoom Meeting and Zoom Phone users that enable this integration. For Zoom and their customers, Dubber brings a critical capability to answer the demand for compliance recording, AI enhanced insights and policy based management.”

“Helping our customers to get the most value from their voice data is an important objective for Zoom,” said Paul Magnaghi, Global ISV Program Leader. “Dubber works to assist customers in meeting their compliance obligations and gain valuable business intelligence from voice data, especially in this time of remote and hybrid working models.”

Dubber’s cloud-based Unified Call Recording solution integrated with Zoom allows a wide variety of businesses to unlock the value of conversations through voice data.

Dubber with Zoom offers key capabilities valued by enterprises and government clients including:

- Available globally today in the Zoom App Marketplace

- Dubber centralises a user’s Zoom Phone (voice) and Zoom Meeting (video/meeting data) cloud recordings

- When enabled via the Zoom App Marketplace, Dubber ingests a user’s cloud recordings from Zoom, storing them centrally, protecting them for compliance purposes while making audio and voice data available to users and other business applications

- DUB AI users will benefit from AI-powered transcriptions, sentiment, tone, notifications and alerts enriching their Zoom recordings

“We have a rich innovation roadmap for Dubber with Zoom,” said James Slaney, Chief Operating Officer, Dubber. “With Dubber, Zoom users are now able to integrate personal call recording with Unified Call Recording. Critically, every conversation can then be transformed into intelligence to power customer experience, employee engagement and compliance insights.”

Background, Dubber with Zoom:

- Available for order now from Dubber and registered Dubber resellers and partners

- Dubber is live and can be easily activated in the Zoom App Marketplace

- Flexible plans start at $14.95 (USD) per user/month for CALL DUB and $29.95 (USD) per user/month for DUB AI

- Dubber currently supports Voice Unified Call Recording (UCR) for Zoom Meetings and Zoom Phone offerings

- Access Dubber on the Zoom App Marketplace here

About Dubber:

Dubber is unlocking the potential of voice data from any call or conversation. Dubber is the world’s most scalable Unified Call Recording service and Voice Intelligence Cloud adopted as core network infrastructure by multiple global leading telecommunications carriers in North America, Europe and Asia Pacific. Dubber allows service providers to offer call recording for compliance, business intelligence, sentiment analysis, AI and more on any phone. Dubber is a disruptive innovator in the multi-billion dollar call recording industry, its Software as a Service offering removes the need for on-premise hardware, applications or costly and limited storage.

For more information, please contact:

Investors: Simon Hinsley simon.hinsley@dubber.net+61 (0) 401 809 653

UK Media: James Taylor | The PR Networkjames.taylor@thepr.network+44 (0)7796 138291

AU & NZ Media: Terry Alberstein terry@navigatecommunication.com.au+61 (0) 458 484 921

US Media: Charlie Guyer, Guyer Group for Dubbercharlie@guyergroup.com+1.617.599.8830

A business needs to listen to and understand two key groups. Sure, customers are vital, they are, after all, where the revenue comes from. But the front-line employees who determine how customers view your business are also important.

You can build loyalty with both groups and get to know them better by listening to what they say. The big question is how do you listen?

Start by putting humans first

Bots and automation have a place, yet for most of your customers, talking to a real person on the phone remains as important as ever. Want proof? More than seven in ten Americans would rather talk to a human than deal a chatbot or other automated process.

Chatbots and FAQs are best when it comes to dealing with minor queries. When a customer faces a bigger problem, they prefer to speak to a human. That means a phone call.

It’s not hard to see why. We know the three pillars of customer service are; a quick resolution, knowledgeable service agents, and a fast response. Customers feel valued when they speak to a knowledgeable agent who can respond in detail and at length. They want someone to listen to them.

The price of not listening can be high: Three out of four stop using an organisation’s services after a poor customer service experience.

So investing in customer service with a human voice makes good business sense.

Know your customer

Listening to customers makes them feel valued. It also gives you an opportunity to learn more about their needs and wants than you could ever get from an automated system.

By getting to know customers better, you can give them what they want. You can tailor your services, make appropriate offers. This pays off with more customer loyalty and that fuels more revenue.

Most businesses still have a long way to go when it comes to understanding customers. Almost a third of customers say they are frustrated that businesses don’t understand them or their needs.

One of the best ways to improve is by learning from mistakes.

Advances in voice AI and sentiment analysis provide the tools needed to filter negative calls to quickly identify customer complaints, or instances where customer service was lacking.

Understanding what your customers don’t like can be just as important as figuring out what they do. Analysing negative calls can identify areas for improvement – whether across products, services or experiences – and create opportunities for wins. Using data-driven decision making, businesses can increase sales, grow loyalty, and even improve their employee experience by reducing the number of negative customer calls they receive.

Do it right, do it once

One top customer frustration is having to repeat themselves when switching between channels or agents.

When a customer has to run through their problem a second time or repeat their personal details they see their call is not being resolved quickly. It also makes it look as if the person taking their call is not knowledgeable. That fails two of the pillars of customer service.

If you can’t provide a smoother, unified experience, your business will fall behind those who do. This is important if you offer omni-channel service. If you can’t offer it across a single service channel, you’re in trouble.

Pull it all together

Creating a unified customer experience needs a central repository of data from all previous conversations. The smartest way to achieve this is by using cloud native unified call recording that integrates voice data with existing business applications. Voice AI can turn those recorded conversations into a transcript.

When you pull data from previous conversations into a CRM system, data that includes a full transcript, your customer service agents can refer back to earlier conversations. This means customers don’t need to repeat themselves.

In the future consumers want more, not less, human interaction. Your business wants better customer interactions. Technology means you can do both at the same time. Better interactions mean you can make better personalised offers. You can adapt future conversations to the customer’s individual style and remember previous conversations so customers are not asked to repeat themselves.

Engage your staff

Your customer service employees define your customers’ relationship with your business. The more engaged they are, the better your business will perform. They’ll collaborate better and have higher productivity. Engaged workers are more likely to stay and less likely to take time off work. They will be enthusiastic about their work and about your business.

Keeping customer service workers engaged means a better customer experience. It also means cost savings: for a 100-employee organization, a 10 percent improvement in employee retention reduces costs by $50,000. If you can cut your staff turnover from 20 percent to 18 percent, that means two fewer employees to hire and onboard.

Staying engaged with remote working

Your customer service employees are more likely to stay engaged if you make their working life as easy as possible. That means giving them all the tools they need to do their job. This is especially true with remote workers who may miss human interaction.

Be wary of app fatigue. Using too many tools can disrupt workflows and drain productivity. Unified communications helps people stay focused. Most workers prefer the idea of having all communications in one place. Many workers believe a unified platform would help them achieve a better workflow, be more productive at work, and help work feel less chaotic.

Giving your workers a single, central repository of customer interactions will give them the insight they need to provide a better service.

Unified Call Recording and Voice AI

Unified call recording and voice AI will help you listen better to the voices that matter for your business. You’ll have a better understanding of your customers and their needs. At the same time, you’ll have valuable insights into keeping your employees engaged and focused.

Voice AI can bring things to your attention and even expose wants or needs that are not directly expressed. It can give you the information you need to deliver a better customer experience. You can reduce negative calls by learning from complaints. AI software can analyse and identify customer sentiment alerting you to problem areas. Positive calls can help you train staff and identify the best performers.

You can integrate AI voice and call recording into unified communications platforms and CRM to capture information at every customer touch point. This has the added benefit of easing app fatigue with your employees.

You can become a better listener by delegating some of the listening to Voice AI

To protect and enable their employees, enterprises need to enable productivity without compromising on security. With centralised security controls, enterprises can grant access to business tools and applications without the headache of different login credentials for each system. In order to reduce IT complexity while retaining full control over employee access, enterprises are working with identity providers for their workforce.

Password fatigue is all too common, with the explosion of workflow applications and software tools that we use each day. It’s no surprise that password fatigue often results in credentials being recycled across multiple platforms and services. In fact, 80% of data breaches are caused by stolen, weak or default passwords. Identity providers not only relieve the burden of password fatigue but also mitigate risk of data breaches.

This is why our latest platform release includes the enablement of identity provider single sign-on (IdP SSO). This new functionality enables businesses to manage access to recordings on the Dubber platform through their existing identity provider (IdP).

IdPs create and maintain identity information for users within an enterprise, enabling them to authenticate access to business applications. When a business deploys an IdP, access to applications can be centrally managed through the IdP rather than requiring a separate authentication process for each application.

Take control of access to recordings

This new feature gives overarching control to enterprises. Just as they do with other applications within their business, systems administrators now have the option to grant their users access to the Dubber platform and customise this access at any time, using their chosen IdP – setting their own authentication requirements, access permissions or restrictions.

Users with correct permissions can use single sign-on (SSO) to access the Dubber platform with their IdP credentials. With access granted through the IdP, any advanced access controls such as multi-factor authentication, password strength, IP block-list or time restrictions will apply to Dubber.

Enable IdP SSO today

New Dubber customers can configure IdP SSO during account creation while existing customers can add this functionality by requesting it through their service provider, account manager, or support contact. Once IdP SSO is enabled, this will be the only authentication process that will allow access to the Dubber platform.

Contact your Dubber account representative or our support team for more information on how you can enable IdP SSO.

Download the Interim Financial Report for the half-year ended 31 Dec 2020 below.